How much should I be saving? | UK average savings by age

Like most things, saving money is a marathon not a sprint, and deciding how much money you should be saving isn’t an easy decision. Simply put, you should save as much as you can afford to each month - to help plan for your future as well as any unexpected emergencies – which people told us is the main reason they save money.

UK average savings by age

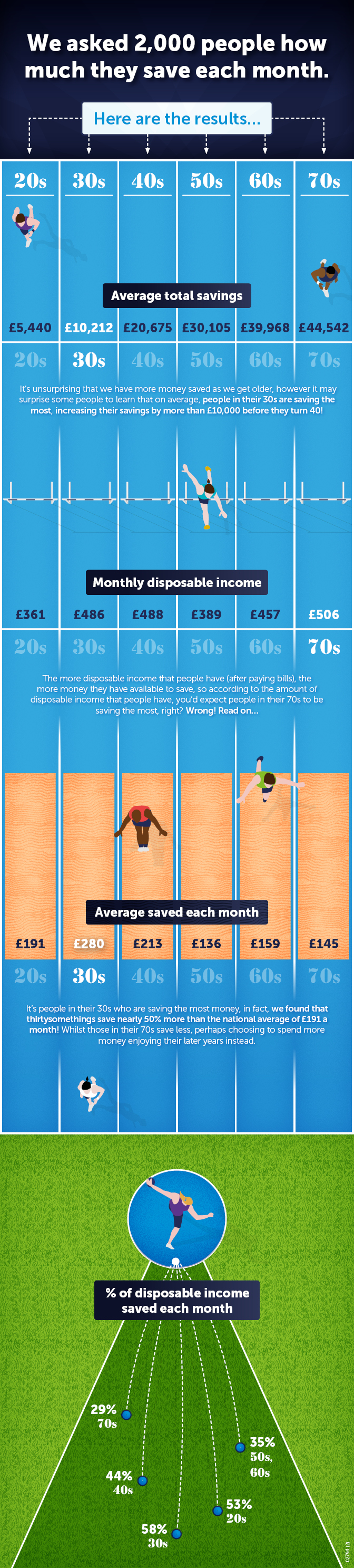

To help decide the right amount for you, we asked 2,000 people how much they save. Take a look at the infographic below to learn how people in different age groups are saving - from their 20s right through to their 70s.

The right time to save

So there you have it. You know how much money people put away each month, and that your 30s are your savings peak, with almost 60% of a 30 year old’s disposable income going straight into a savings account each month.

However, don’t worry if your savings plan isn’t across the finish line just yet. We’ve pulled together everything you need to know about savings accounts to help you make the right choice for your money.

1 Opinium conducted research among 2,004 adults living in the UK on behalf of Charter Savings Bank between 12th – 16th October 2018

Savings

Popular posts like this

- Autumn Budget – ISA allowance update

- We’ve won Best Overall Savings Provider – for the eighth year running!

- How UK households are building financial safety nets

- Find out why every pound counts

- Saving smarter: myths vs reality

- Sunny Day Savings

- Be ISA Wiser about the new ISA changes

- Is an Easy Access account for you?

- 5 savvy saver tips to build your money

- Could you boost your pension pot with an ISA?

- Head in a spin? Your ISA questions answered

- Time to celebrate 10 years of CSB

- We’re your ISA Provider of the Year!

- Key Savings Definitions You Should Know

- Three ways to be ISA wiser before the tax year ends

- Five advantages of Easy Access savings accounts

- What is a Fixed Rate Bond?

- Cash ISA transfers – what do you need to know?

- 3 reasons why an Easy Access Cash ISA may be a good savings option for you

- Personal Savings Allowance – what’s it all about?

- Understanding different types of ISA

- The 9 most important Cash ISA questions you need to ask

- Top 3 ways to make the most of your ISA before the end of the tax year

- Did you know you could earn monthly interest by opening one of our fixed rate bonds?

- 12 ways to save money at Christmas

- What kind of saver are you?

- We’ve made improvements to your maturity options journey

- Could a Notice account be good for you?

- We’re your ISA Provider of the Year - for the fifth year running!

- You voted us Online Savings Provider of the Year

- Cash ISA transfers – what do you need to know?

- Thank you for voting for us at the Moneyfacts Awards

- Supporting you through a bereavement

- Award-Winning Savings

- What we’re saving for in 2022 | Infographic

- A huge thank you!

- How much should I be saving? | UK average savings by age

- Savings accounts: everything you need to know

- Understanding different types of ISA

- Revealed: average pocket money in the UK

- The 9 most important ISA questions you need to ask

- Customers vote Charter Savings Bank Best Online Savings Provider for third year in a row

- Charter Savings Bank strikes twice at the Moneynet Awards

Categories

More news

Financial Services Compensation Scheme

Your eligible deposits held by a UK establishment of Charter Savings Bank are protected up to a total of £120,000 by the Financial Services Compensation Scheme, the UK’s deposit protection scheme. Any deposits you hold above the limit are unlikely to be covered. Please click here for further information or visit www.fscs.org.uk.