Revealed: average pocket money in the UK

Knowing how much money to pay your kids isn’t easy. To understand the average pocket money paid in different parts of the UK, we recently surveyed parents and grandparents to learn more about the decisions that we make when paying an allowance to our kids.

Pocket money is a hotly contested topic in some UK households, with kids’ demand for the latest gadgetry and games usually the driving force behind the crusade for more cash. But knowing just how much money you should pay kids, doesn’t always come easily.

Our research found that parents and grandparents spend an astonishing £11.1 billion on pocket money each year, and they also told us that the amount of cash they hand over to kids largely comes down to the following factors:

- The age of the child (59%)

- The amount of pocket money you can afford to give (36%)

- The amount you gave to their older siblings/cousins (14%)

Pocket money – what parents and grandparents are paying

The average amount of pocket money paid by parents and grandparents in the UK is almost £13 per week, with the most amount of people paying between £5 and £9.99. Meaning that on average, UK children are earning just over £50 in pocket money each month.

You may also want to consider how much your kids are earning elsewhere, for example, we found that collectively parents and grandparents spend over £213 million on pocket money every week.

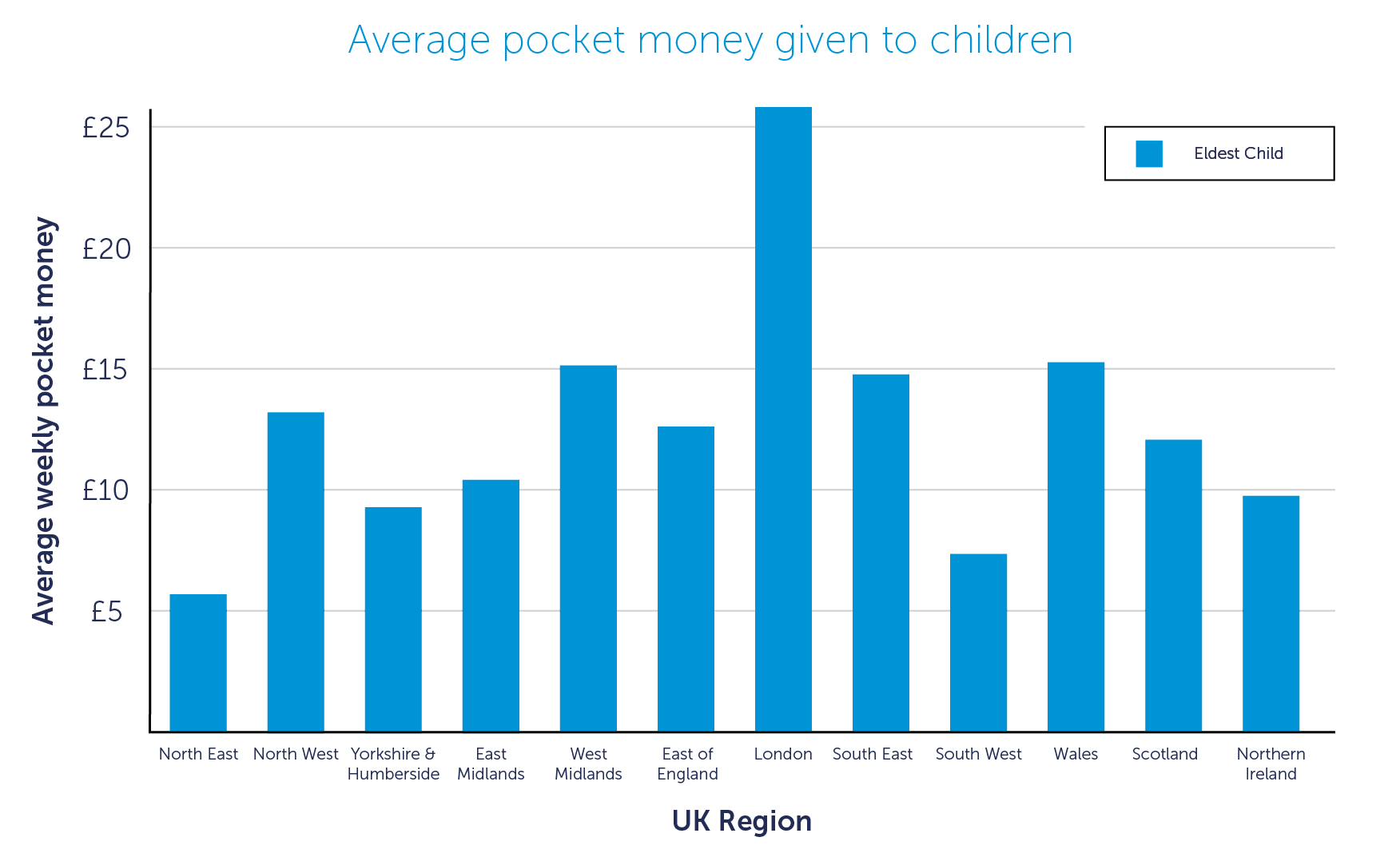

If you’re more interested in paying the going rate according to your region of the UK, you may find the following graphic useful:

We also found that not all of us pay siblings the same amount and, that on average, first-born children receive 34% (over £190) more from parents each year – so it pays to be the first born child.

How kids can use their pocket money wisely

Your kids are sure to have ideas about what they’d like to spend their money on as soon as they get it. Perhaps they’re on their way to the sweet shop as soon as you hand over the money, or maybe they’re set on trying on yet another trendy t-shirt.

Most of us would be more comfortable paying a bit more pocket money each month if we knew our kids or grandkids were using it for their future, or that they’re passionate about putting it towards a cause that they really care about.

36% of people told us they encourage their kids with advice about how to spend and save pocket money, so that it can be spent less flippantly on something that kids really want.

Here’s a few alternative ideas to help encourage your kids not to waste their weekly budget.

-

Pay pocket money straight into a piggy bank

By paying money straight into your child’s piggy bank you’ll be surprised at how excited your kids will be as their savings grow and their piggy bank gains in weight. Just be sure to add their pocket money at the same time each week – routine is key to saving!

They’ll also understand the down side to removing money (and having less in there) if they choose to spend some.

-

Pay some of the pocket money straight into a savings account

By paying some of their pocket money directly into a savings account, you’re joining 19% of people in the UK who insist on keeping some of their pocket money out of reach from their kids.

It makes sense to form a savings habit early, and by paying into a savings account, you’ll also benefit from the interest and security that a savings bank provides.

-

Insist they spend it on something specific

If you’re worried about your kids wasting money, spend a little time each week to talk about the things your kids are planning on spending their pocket money on, and perhaps plant an idea for something more worthwhile, maybe to save up for a stationary kit to help with homework, or some tools to spend some family time in the garden.

This is a good way to make sure their pocket money goes further than the corner shop, and a way for them to realise the benefit of hanging on to their cash for the long run or at least something they really want.

-

Give some away to charity

There’s nothing more rewarding than seeing children do a good deed. Helping people is a wonderful sentiment to pass on to your kids, and so if they’re struggling for ideas to spend their money on, why not donate to a cause that’s close to their heart.

If you need help finding a cause that your child is excited to donate to, visit the charity register on gov.uk where you can search through a list of registered charities.

Teach children the value of their pocket money

It’s generally easier to save if you do so on the day that you get paid, so consider having a conversation about saving money with your kids or grandkids on the day that you hand over their pocket money, helping firmly cement a savings mind-set into their future.

For example, you could explain that saving just half of their £50 each month (the average amount paid in the UK) would enable them to build up £300 over a year, which is money they can earn interest on and put towards future adventures – whilst leaving enough for them to spend on things they want more immediately.

It’s a great chance to help kids start to make spending and savings decisions, as well as understand the importance of having money saved for emergencies.

It’s generally easier to save if you pay money into a savings account on the day that you get paid, so consider having a conversation about saving money with your kids or grandkids on the day that you hand over their pocket money, helping firmly cement a savings mind-set into their future.

Source: Opinium conducted research among 2,009 adults living in the UK on behalf of Charter Savings Bank between 13th and 15th August 2019

Savings

Popular posts like this

- Autumn Budget – ISA allowance update

- We’ve won Best Overall Savings Provider – for the eighth year running!

- How UK households are building financial safety nets

- Find out why every pound counts

- Saving smarter: myths vs reality

- Sunny Day Savings

- Be ISA Wiser about the new ISA changes

- Is an Easy Access account for you?

- 5 savvy saver tips to build your money

- Could you boost your pension pot with an ISA?

- Head in a spin? Your ISA questions answered

- Time to celebrate 10 years of CSB

- We’re your ISA Provider of the Year!

- Key Savings Definitions You Should Know

- Three ways to be ISA wiser before the tax year ends

- Five advantages of Easy Access savings accounts

- What is a Fixed Rate Bond?

- Cash ISA transfers – what do you need to know?

- 3 reasons why an Easy Access Cash ISA may be a good savings option for you

- Personal Savings Allowance – what’s it all about?

- Understanding different types of ISA

- The 9 most important Cash ISA questions you need to ask

- Top 3 ways to make the most of your ISA before the end of the tax year

- Did you know you could earn monthly interest by opening one of our fixed rate bonds?

- 12 ways to save money at Christmas

- What kind of saver are you?

- We’ve made improvements to your maturity options journey

- Could a Notice account be good for you?

- We’re your ISA Provider of the Year - for the fifth year running!

- You voted us Online Savings Provider of the Year

- Cash ISA transfers – what do you need to know?

- Thank you for voting for us at the Moneyfacts Awards

- Supporting you through a bereavement

- Award-Winning Savings

- What we’re saving for in 2022 | Infographic

- A huge thank you!

- How much should I be saving? | UK average savings by age

- Savings accounts: everything you need to know

- Understanding different types of ISA

- Revealed: average pocket money in the UK

- The 9 most important ISA questions you need to ask

- Customers vote Charter Savings Bank Best Online Savings Provider for third year in a row

- Charter Savings Bank strikes twice at the Moneynet Awards

Categories

More news

Financial Services Compensation Scheme

Your eligible deposits held by a UK establishment of Charter Savings Bank are protected up to a total of £120,000 by the Financial Services Compensation Scheme, the UK’s deposit protection scheme. Any deposits you hold above the limit are unlikely to be covered. Please click here for further information or visit www.fscs.org.uk.