Sunny Day Savings

Are you a Sunny Day Saver?

If you’re a glass-half-full kind of person, perhaps you also approach your savings with the same positive mindset. Well, according to our recent “Sunny Day Savings” research, you’re not the only one.

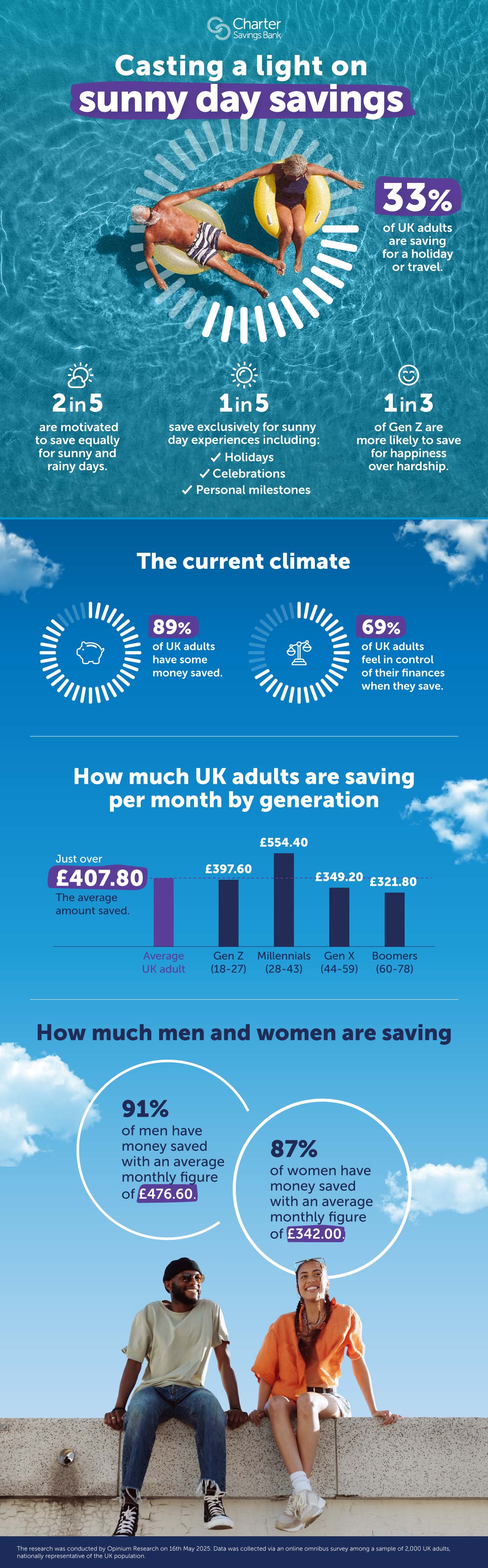

We collected responses from around 2,000 UK adults, looking at what motivates people to save, and demographic differences in saving patterns including those across generation and gender.

What’s motivating savers?

Come rain or shine, people are putting their money away. Nine in 10 of those surveyed have some money saved, which shows Brits have a strong drive to make the most of their money, but what are they saving for?

One in five are saving for sunny days, such as travel, home renovations or retirement.

Three in 10 are saving for rainy days, which include unplanned home repairs, car repairs, medical emergencies, pet costs, sudden bill rises, family emergencies or job loss.

Four in 10 are motivated to save for both sunny and rainy days, indicating that the majority of savers have taken a balanced approach.

How you could grow your finances

Whether a Sunny Day Saver or not, seven in 10 said they feel more in control of their finances when they’re contributing to their savings.

If you’d like to explore how you could enjoy a brighter future by maximising your savings, take a look at our range of products that have been designed to meet both your sunny day and rainy day goals.

Savings

Popular posts like this

- Autumn Budget – ISA allowance update

- We’ve won Best Overall Savings Provider – for the eighth year running!

- How UK households are building financial safety nets

- Find out why every pound counts

- Saving smarter: myths vs reality

- Sunny Day Savings

- Be ISA Wiser about the new ISA changes

- Is an Easy Access account for you?

- 5 savvy saver tips to build your money

- Could you boost your pension pot with an ISA?

- Head in a spin? Your ISA questions answered

- Time to celebrate 10 years of CSB

- We’re your ISA Provider of the Year!

- Key Savings Definitions You Should Know

- Three ways to be ISA wiser before the tax year ends

- Five advantages of Easy Access savings accounts

- What is a Fixed Rate Bond?

- Cash ISA transfers – what do you need to know?

- 3 reasons why an Easy Access Cash ISA may be a good savings option for you

- Personal Savings Allowance – what’s it all about?

- Understanding different types of ISA

- The 9 most important Cash ISA questions you need to ask

- Top 3 ways to make the most of your ISA before the end of the tax year

- Did you know you could earn monthly interest by opening one of our fixed rate bonds?

- 12 ways to save money at Christmas

- What kind of saver are you?

- We’ve made improvements to your maturity options journey

- Could a Notice account be good for you?

- We’re your ISA Provider of the Year - for the fifth year running!

- You voted us Online Savings Provider of the Year

- Cash ISA transfers – what do you need to know?

- Thank you for voting for us at the Moneyfacts Awards

- Supporting you through a bereavement

- Award-Winning Savings

- What we’re saving for in 2022 | Infographic

- A huge thank you!

- How much should I be saving? | UK average savings by age

- Savings accounts: everything you need to know

- Understanding different types of ISA

- Revealed: average pocket money in the UK

- The 9 most important ISA questions you need to ask

- Customers vote Charter Savings Bank Best Online Savings Provider for third year in a row

- Charter Savings Bank strikes twice at the Moneynet Awards

Categories

More news

Financial Services Compensation Scheme

Your eligible deposits held by a UK establishment of Charter Savings Bank are protected up to a total of £120,000 by the Financial Services Compensation Scheme, the UK’s deposit protection scheme. Any deposits you hold above the limit are unlikely to be covered. Please click here for further information or visit www.fscs.org.uk.